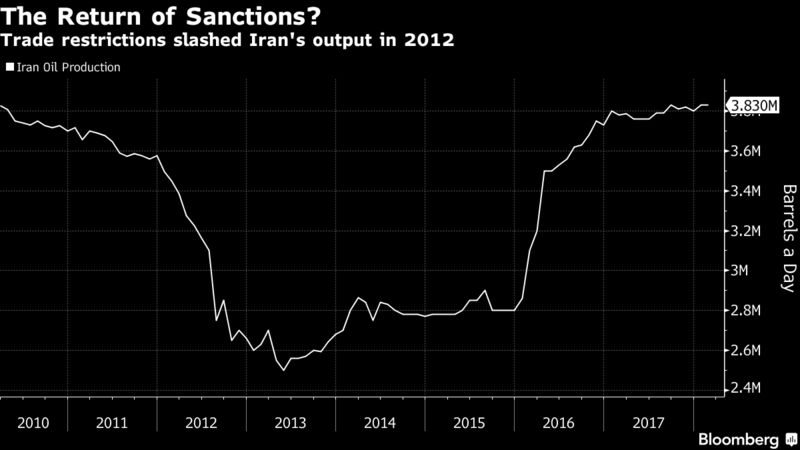

Futures rose as much as 1.2 percent to a six-week high, after advancing 2.1 percent on Tuesday. Donald Trump hinted at withdrawal from a deal curbing Iran�s nuclear program as Saudi Arabia�s Mohammed Bin Salman began a U.S. visit. Such a decision would raise the risk of the OPEC member�s oil exports being curtailed by sanctions.

The specter of conflict involving giant producers is jolting prices, which have traded in a tight range since February. With the Organization of Petroleum Exporting Countries and its allies concluding that the market will rebalance by the end of September, Citigroup Inc. predicts oil�s recent �sideways� move is unlikely to last. Still, investors will be wary of growth in U.S. supply, which has threatened to undermine OPEC�s efforts to eliminate a global glut.

�The possibility of new sanctions on Iran has been the main issue in recent days,� said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt. �Oil sanctions against Iran would have a greater impact in an undersupplied market than in an oversupplied one.�

Brent for May settlement rose as much as 82 cents to $68.24 a barrel on the London-based ICE Futures Europe exchange, the highest intraday price since Feb. 5. The contract traded at $68.10 as of 10:48 a.m. local time. The global benchmark crude traded at a $3.95 premium to West Texas Intermediate.

WTI for May delivery advanced 61 cents to $64.15 a barrel on the New York Mercantile Exchange. Total volume traded was about 30 percent below the 100-day average. The April contract expired Tuesday after climbing 2.2 percent to $63.40, the highest close for front-month futures since Feb. 26.

If Trump decides to exit the international accord under which sanctions on Iran were eased in return for curbs on its nuclear program, Saudi Arabia, which regards the deal as a boon for its regional foe, would likely welcome the move. The resumption of sanctions could reduce oil exports from the Persian Gulf state by 250,000 to 500,000 barrels a day by the end of this year, industry consultant FGE said last week.

In the U.S., the American Petroleum Institute was said to report that nationwide crude stockpiles tumbled 2.74 million barrels last week. That would be the largest decline since early January if confirmed by the Energy Information Administration, scheduled to release the data later Wednesday. A Bloomberg survey shows inventories probably moved the other way, climbing by 3.25 million barrels.