Purchases are model's first by new airlines in three years

Iran�s surprise agreement to buy the Airbus Group SE A380 marks the second new deal for the superjumbo in three weeks and will help the planemaker paper over the cracks in its flagship program -- for now.

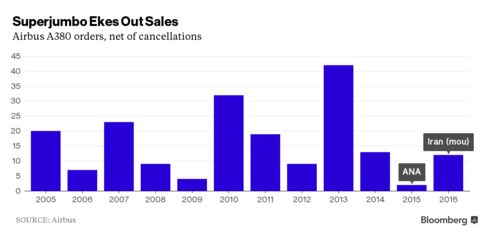

The Iranian accord for 12 A380s, announced Thursday, together with the sale of three of the double-deckers to Japan�s All Nippon Airways Co., disclosed in order data on Jan. 12 and confirmed Friday, provides some cheer for Airbus after the model failed to find a single new airline buyer in three years.

The 15 jets, worth $6.5 billion at list prices, will provide a vital breathing space as the Toulouse, France-based manufacturer seeks to drum up further orders and determine whether a life-extending upgrade of the jet sought by leading buyer Emirates of Dubai is viable.

The planes will provide at least six months of work for the A380 line at the current build rate of 30 aircraft a year, swelling a backlog that was sufficient to support output only through about 2018. Airbus is seeking cost cuts to drop the annual break-even level to 25 or fewer, further eking out production.

�The new orders may help push back the need for a new-engine version of the A380, thus encouraging potential airliner buyers to move forward more quickly with orders,� said Yan Derocles, an analyst at Oddo Securities in Paris with a �buy� rating on Airbus stock.

Japan Breakthrough

The Iranian commitment, likely to be for flag-carrier Iran Air, is especially welcome since Airbus has been seeking to sell the A380 to companies beyond the best-known first-tier operators for years, with only limited success. The carrier was a global player in the 1970s and even placed an order for the supersonic Concorde, which was canceled after the 1979 revolution.

The last new airline buyer for the A380, No. 2 Russian carrier Transaero, collapsed last year after agreeing to buy four planes.

Confirmation of Japan�s ANA deal also comes as a coup, with the Asian nation not only a long-established customer for Boeing Co. but also a leading market for the 747 jumbo, which remains in production as the 747-8 Intercontinental. A bid to penetrate Japan in the past failed when Skymark Airlines Inc. went in to bankruptcy protection with six A380s on order.

While two new orders won�t by themselves save the world�s biggest commercial aircraft, the deal signed by Iranian President Hassan Rouhani points to new opportunities. Airbus will now likely step up sales campaigns in other Muslim nations, both for network needs and as mass transports in the Haj pilgrimage.

Denser Layout

PT Garuda Indonesia is seen as a prime candidate, as is Turkish Airlines, and Saudi Arabia could be targeted with a higher-density version of the plane that Airbus has begun offering. Iran�s seating plans haven�t been revealed, though it�s likely to configure its A380s with more than the standard 550 berths, helping to reinforce the model�s credentials as an industry workhorse.

The A380 has also received a recent vote of confidence from British Airways owner IAG SA. The carrier, which already has 12 A380s in operation or on order, said last week it was evaluating whether to add a batch of five or six used planes.

While Airbus would prefer to sell new superjumbos, such a move would be valuable in establishing a second-hand market for the plane. That�s something the manufacturer is keen to do given that the oldest examples in service with Singapore Airlines Ltd. and Emirates may become available as early as 2017.

Airbus also seems to have little to fear from the 747, with diminishing customer interest causing Boeing to say this week that production will drop to six jumbos a year from September.

Ultimately, though, Airbus needs hundreds of new A380 orders if the superjumbo is to remain in production for another decade or longer.

By that time, the company reckons more crowded airports will create a much bigger market. Bridging that gap means securing a deal from Emirates for 150 or even 200 more aircraft -- something the Gulf carrier says must be accompanied by a costly makeover that includes new engines.

By Bloomberg