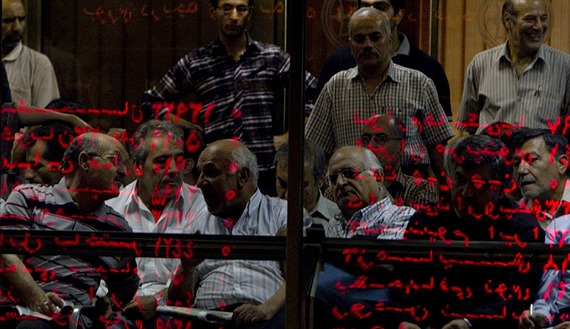

Investors look at an electronic display board reflected in a glass partition at the Tehran Stock Exchange, Sept. 15, 2010. (photo by REUTERS/Caren Firouz)[/caption]

Investors look at an electronic display board reflected in a glass partition at the Tehran Stock Exchange, Sept. 15, 2010. (photo by REUTERS/Caren Firouz)[/caption]This week,�another sharp drop in the Tehran Stock Exchange Index (TEPIX) served as a reminder that some of the structural issues in Iran�s main capital market need to be addressed.

Since the beginning of the current Iranian year (March 21, 2014) the TEPIX has dropped by 8% ��a fact that has worried Iranian investors. Though this week�s sharp decline (2.5% drop on June 14-15) came to a halt on June 16, concerns remain that further fluctuations will undermine Iran's capital market. The most recent drop also indicates that the government�s April 2014 decision to inject some liquidity into the market was just a short-lived remedy that failed to address deeper structural shortcomings.

Market fluctuations are heavily influenced by domestic political and geopolitical events. The most recent such event has been the emerging threat from the terrorist organization the�Islamic State of Iraq and al-Sham�(ISIS). Interestingly, the Iranian market has calmed down following the start of a new round of nuclear negotiations in Vienna as well as the news that Iran and the United�States�may�collaborate to contain the ISIS threat.

Read more here

The Iran Project is not responsible for the content of quoted articles.