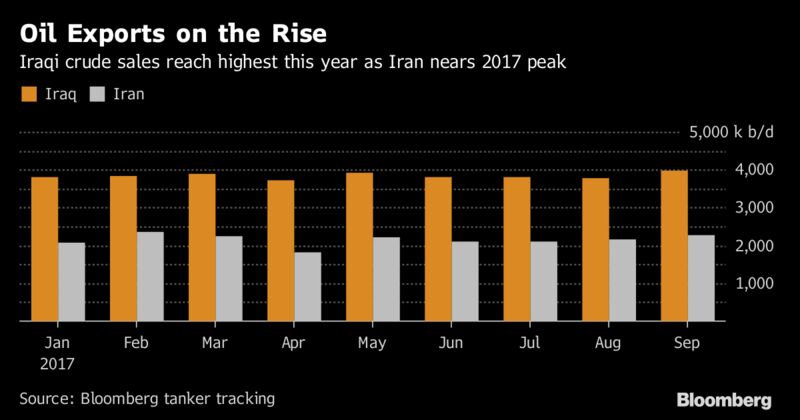

�Iraq shipped 3.98 million barrels of crude a day, the highest since December, while Iran�s exports rose to 2.28 million barrels a day, the most since February, according to ship-tracking data compiled by Bloomberg. Saudi Arabia�s exports were�6.68 million barrels�a day, the second-lowest for this year, the data show.

Iran and Iraq�s moves to grab market share cast a light on the internal tensions within OPEC as Saudi Arabia, the group�s de facto leader and world�s top oil exporter, works to re-balance the global market. State-run Saudi Arabian Oil Co., known as Aramco, will make the deepest allocation cuts to customers in its history in November, the energy ministry said Monday in a statement.

��Iraq and Iran are both very opportunistic in selling into markets where buyers are no longer getting the same Saudi volumes,� said Richard Mallinson,�an oil analyst at Energy Aspects Ltd. in London. �We�ve seen Saudi Arabia�s exports lower over the last several months, which is consistent with their focus on the re-balancing process.�

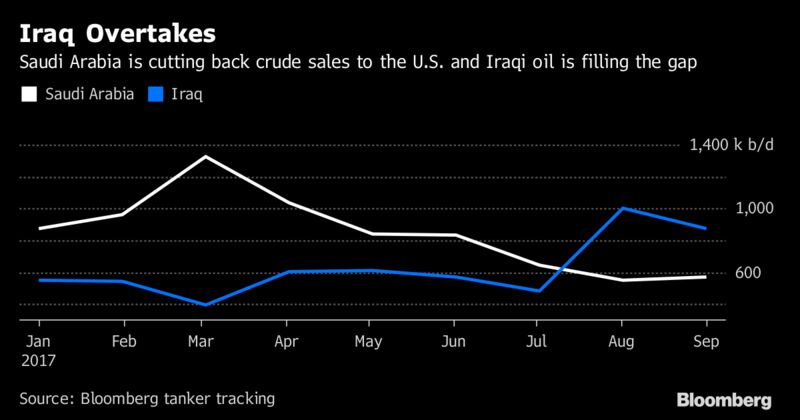

Saudi Arabia�s Energy Minister Khalid Al-Falih in May promised the country would �markedly� reduce exports to the U.S. in an effort to curb swollen crude inventories. Shipments to the U.S. have dropped from March through August, when they reached the lowest this year, according to the tanker data. Overall Saudi exports plunged to the lowest in 34 months in July and were about 1 million less than a year earlier, according to the Joint Organisations Data Initiative. Riyadh-based JODI collects data including production and exports directly from countries.

Iraq exported 871,000 barrels of crude a day to the U.S. in September, exceeding Saudi Arabia for a second straight month,�according to tanker tracking data. Iraq shipped almost twice as much crude as the Saudis did to�the U.S. in August,�the data show.

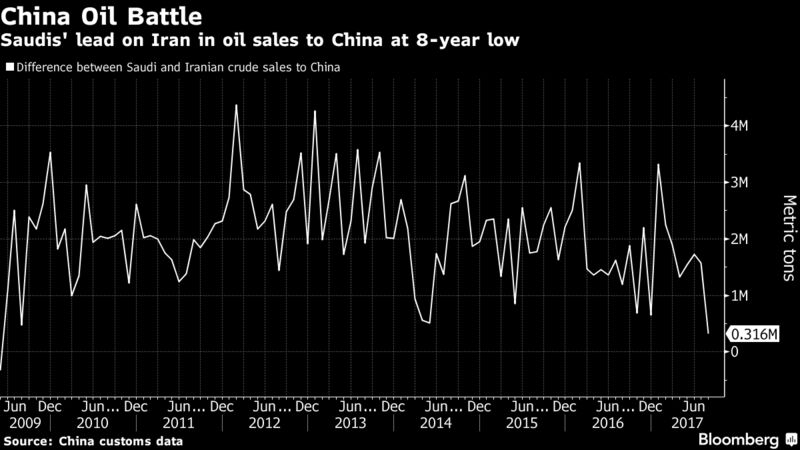

Iran is also gaining on Saudi Arabia in crude sales to China.

The difference between China�s imports of Saudi oil and Iranian crude is at an eight-year low, according to customs data from the Asian country. Saudi Arabia shipped 833,000 barrels of crude a day to China in September, compared with 600,000 barrels a day from Iran. OPEC�s third-largest producer has ramped up output and doubled exports since sanctions on its energy industry were eased in January 2016.

�In Iran, I�m expecting production to keep creeping up in the coming months and that exports will be up slightly,�� said Robin Mills, chief executive officer of Dubai-based consultant Qamar Energy. �I do see them taking market share slowly from the Saudis if the Saudis hold steady on their production cuts.�

Iran and Iraq will have to fight to keep their gains. Both are subject to the Organization of Petroleum Exporting Countries� production limits, and while they are working to raise output capacity, they are already pumping at or close to their limits. Mallinson said their efforts to win market share won�t put OPEC�s production cuts at risk. Iran, still facing some U.S. restrictions on financing, is seeking investment and technology to raise output.

Once OPEC�s cuts deal expires, Saudi Arabia will be able to increase output, potentially returning to its record 10.7 million barrels a day reached in July 2016. OPEC meets in November to discuss a possible extension of the deal which is set to expire in March. Improving demand may mean there�s room for all in the market when the deal is over, according to Mallinson.

�We�re seeing a market shift as stockpiles begin to clear, and there will be more demand,��the Energy Aspects analyst said. �There shouldn�t be a problem in placing barrels when OPEC does resume full production after the current cuts end.�

� With assistance by Brian Wingfield