BEIJING (Reuters) - A Chinese tanker loaded crude in Iran in March, according to shipping data and an industry official, the first time a China-flagged ship has transported Iranian crude since EU sanctions imposed last July stopped insurers covering the shipments.

BEIJING (Reuters) - A Chinese tanker loaded crude in Iran in March, according to shipping data and an industry official, the first time a China-flagged ship has transported Iranian crude since EU sanctions imposed last July stopped insurers covering the shipments.

The United States and Europe imposed tough sanctions in 2012 that aim to choke Iran's oil revenue and force the Islamic Republic to halt its disputed nuclear programme.

Unable to find insurance for its own vessels because of the sanctions,China has relied mainly on the National Iranian Tanker Company (NITC) to ship Iran's crude to Chinese refineries over the past nine months.

If China has put in place a system of insurance for its own vessels allowing them to participate in the trade again, the country's refineries could boost imports. China is Iran's largest trade partner and biggest oil client, buying around 440,000 barrels per day (bpd) in 2012.

The Chinese-owned supertanker Yuan Yang Hu, with capacity to carry 2 million barrels of crude, called at Iran's Kharg Island on March 20-21 and is en route to China, shipping tracking data showed.

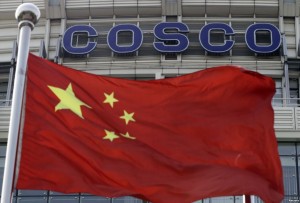

The vessel is owned by Dalian Ocean, a subsidiary of state shipping giant China Ocean Shipping (Group) Company (COSCO).

An official at COSCO's general manager's office said she was unaware of the matter and the company's press official was not available for comment.

Norwegian marine and energy insurance group Skuld said it provided protection and indemnity (P&I) cover - insurance for ocean going ships against pollution and injury claims - for the Yuan Yang Hu.

"We insure ships on a yearly basis and do not usually know what particular activity a ship is engaged in at any one time," Skuld said in a statement. "An owner is not obliged to inform Skuld about the trade he is conducting with the vessel."

Skuld said compliance with EU's regulations was of the "utmost importance".

"Any member who falls within the scope of this exclusion or engages in activity which is contrary to any other provision in the insurance terms and conditions runs the risk of prejudicing their P&I cover," it said.

"The operation of the exclusion is automatic - the exclusion will apply without us being required to give notice to owners."

An industry official with knowledge of the shipment told Reuters separately that the tanker's insurance and reinsurance had been arranged in China. He was unable to provide more details.

"This is the first Chinese vessel (since the ban)... as one of the lifters got special approval from the authorities to lift Iranian oil on a trial basis," said the official, who requested anonymity due to the sensitivity of the matter.

"Insurance is also handled by the Chinese side."

Iran's fleet has struggled to deliver oil to its biggest buyers China, India and South Korea, all of whom had to switch to Iranian vessels for delivery after the EU sanctions came into place.

China's Iranian imports fell 21 percent in 2012 from 2011 to 440,000 bpd partly due to shipping problems. The fall meant China qualified for an exemption to U.S. sanctions, which require buyers of Iranian crude to continually reduce imports.

Beijing has repeatedly stated its opposition to unilateral sanctions outside of the United Nations, such as those imposed by the United States. But it qualified for an exemption anyway, after the shipping delays and a contract dispute led to the sharp fall in imports.

COSCO's chairman Wei Jiafu told Reuters last July, just weeks after the European insurance ban took effect, that the Chinese government could follow Japan's example and provide insurance for Chinese tankers.

Japan found a way around the EU ban last year when the government stepped in to provide $7.6 billion in coverage to tankers carrying Iranian crude bound for Japanese ports.

Insurance companies use reinsurers to hedge their risk, and the reinsurance market is mostly based in Europe. The EU sanctions prevent those reinsurers from participating in transactions that facilitate Iranian crude exports.

The same problem has also arisen in India for refiners seeking insurance for plants that process Iranian crude.

China largest refiner Sinopec processes nearly all the Iranian crude imported into the country, which is shipped in by Sinopec's trading arm Unipec and state trader Zhuhai Zhenrong Corp.

Even without any new arrangement on insurance, oil traders have said deliveries have, since late 2012, "improved significantly" after NITC deployed old tankers and also took delivery of several new vessels from Chinese shipyards.

In the first two months of 2013, China imported about 410,000 bpd of Iranian crude, 3 percent more than a year earlier, according to Chinese customs data.

By Reuters

The Iran Project is not responsible for the content of quoted articles.

QR code

QR code