Iran’s currency fell 8 per cent on Monday amid confusion over the fate of Iran’s central bank governor.

Iran’s currency fell 8 per cent on Monday amid confusion over the fate of Iran’s central bank governor.

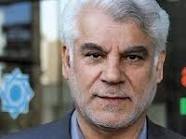

Iran’s domestic media reported on Monday that the Supreme Audit Court, which oversees government expenditure, had “dismissed” Mahmoud Bahmani for “illegal withdrawal of people’s deposits overnight” about one year ago, a charge the central bank has denied.

Parliamentarians have criticised the central bank governor for his failure to curb the fluctuations of the rial but the president has until now refused to remove Mr Bahmani from his post. The Supreme Audit Court is affiliated to parliament, which is locked in a power struggle against Mahmoud Ahmadi-Nejad ahead of presidential elections in June.

Rahmatollah Sharifi, head of the court’s public relations office, said Mr Bahmani had 20 days to appeal the Audit Court ruling. The central bank, however, said it was not aware of any charges against the governor.

Amid the confusion the rial fell to 35,300 rials to the dollar, from 32,800 rials in the open market on Saturday.

Analysts believe there is genuine concern in the political hierarchy that the country’s financial crisis is being exacerbated by tightened international sanctions over the nuclear programme.

Iran’s legislature decided on Sunday to investigate the central bank’s management of the currency market and its policies on interest rates and loans in the Iranian banking sector.

Parliamentary opponents of Mr Bahmani, who are banned by law from removing the governor from his post, believe he has damaged the independence of the central bank by allowing Mr Ahmadi-Nejad’s government to make lavish spending commitments to fund populist policies, including cheap loans and job creation schemes, which they say have fuelled a rise in consumer prices. Inflation officially stands at 27.4 per cent but economists believe it to be at least twice as high.

The top banker is also accused by parliamentarians of mismanagement in the wake of US sanctions imposed last year, which have led to a more than 50 per cent fall of the rial.

Mohammad Qasim Osmani, a parliamentarian, told state television on Monday that the central bank printed money to help the government cover its budget deficit, which further fuelled inflation.

The international sanctions, he said, had affected Iran’s hard currency market “but the Central Bank could do much better” to protect the rial from their impact.

During Mr Bahmani’s four-year tenure at the head of the central bank, the rial has fallen by more than 70 per cent and there has been a more than 70 per cent rise in overdue loans, which have now reached 104 per cent of total deposits at Iranian banks.

Tehran-e-Emrooz, a conservative daily newspaper, wrote on Monday that Mr Bahmani was responsible for imposing “big shocks on the country’s economy?…?the impact of which will affect the poor?…?for years”.

By Financial Times

The Iran Project is not responsible for the content of quoted articles.

QR code

QR code