PARIS — Gazprom has halted gas supplies this week to Ukraine in a dispute over unpaid bills and amid the ongoing conflict between Kiev and Moscow. As a side-effect, Russia says Europe could witness occasional disruptions in its gas supplies that flow through Ukraine.

PARIS — Gazprom has halted gas supplies this week to Ukraine in a dispute over unpaid bills and amid the ongoing conflict between Kiev and Moscow. As a side-effect, Russia says Europe could witness occasional disruptions in its gas supplies that flow through Ukraine.

But imagine another, much more far-reaching scenario, where not a single molecule of methane flows through the pipes that pass via Ukraine, Belarus and the Baltic Sea to provide Europe with the precious fuel.

What if the European Union decided to forego Russian gas in response to President Vladimir Putin’s aggressive stance on Ukraine, effectively ending a 40-year cooperation initiated during the Leonid Brezhnev era of stagnation?

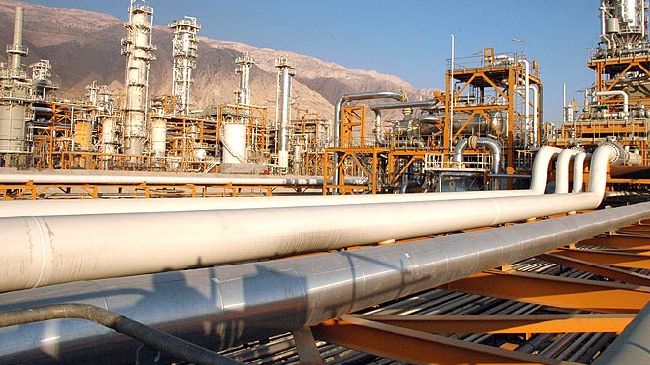

This could happen, some say, because Iran, which looks to become part of the international community again, will make its huge gas reserves — the world’s second largest behind Russia’s — available to the Europeans.

Alas, the Old Continent can find warm comfort and breathe a sigh of relief.

This, of course, is pure fiction. Despite the Ukrainian crisis, Russia is still fulfilling its delivery contracts to Europe. But though Moscow is Tehran’s ally on sensitive issues like Syria, it will do everything to prevent Iranian gas from flowing towards Europe and eating away at the market share of Gazprom, which is responsible for one-quarter of European consumption.

And Iran cannot turn its back on its diplomatic, military and economic cooperation with its powerful neighbor, even though there is ancestral rivalry between the Persian and Russian empires.

Europe, however, is threatening to hit Russia where it hurts: its hydrocarbon exports. As for Iran, it dreams of returning to the global energy game, although in a still very diplomatic manner. “We don’t want to compete with Russia. But we know that Europe’s demand for gas is increasing and would like a share in this,” Iranian Industry Minister Mohammad Reza Nematzadeh recently said, underlining that his country could be a “reliable, secure and long-term” partner for Europe.

Besides, is it totally by chance that he chose to say this in an interview with Germany’s daily newspaper Handelsblatt, when 40% of the gas consumed by Germany comes from Russia?

Iranian appetite

But before Iranian gas can be used as a weapon against Vladimir Putin, the West will need to lift its sanctions on Tehran’s nuclear program. Iran and the “5+1” — the five permanent members of the UN’s Security Council (U.S., Russia, China, France, Britain) and Germany — resumed their talks in Vienna on May 14 and are expected to reach an agreement before July 20. The current temporary deal could be extended by another six months.

Another hurdle will be whether the various political and religious groups in the Islamic Republic can agree on delicate issues, such as the space given to Western companies, the only ones to hold the liquefied natural gas (LNG) technology that allows full-scale exportation. Those most open to development are vocal about their intention to relaunch hydrocarbon production with these companies. On the other hand, the Supreme Leader has regularly dashed investor hopes in the past. Convinced that the talks in Geneva and Vienna will fail, Ayatollah Ali Khamenei periodically insults the West in speeches, and asks Iranians to be prepared to develop their resources alone.

But for some, replacing Russia with Iran is “nonsense.” First of all, because the Islamic Republic consumes growing amounts of gas. According to British firm BP, its consumption rose from 20 million tons of oil equivalent per year in 1990 to 150 million, as different uses developed: pumping in oil wells to improve extraction, fuel and raw material in industries, fuel for vehicles, electricity production, heating for part of the 80 million Iranians, not to mention huge waste.

The country appears incapable of developing its own resources and exports 40 times less gas to Turkey than Russia to Europe. It even imports regularly from Turkmenistan.

“Europe imports 150 billion cubic meters of Russian gas per year,” says Philippe Sauquet, president of Gas & Power at Total. "It’s impossible to turn your back on such large volumes. Replacing it with other sources would lead to a 20% to 30% rise in costs since very expensive infrastructure would need to be built, whereas the pipelines from Russia have already been paid for. Both Europeans and Russians would stand to lose.”

Experts are also skeptical about Iran’s ability to quickly become a large gas exporter. “It’s going to take time to build alternative infrastructures,” Sauquet observes. “Qatar accelerated its policy in 2001, but the production of LNG only really took off in 2010-2011 to reach 70 million cubic meters of export. And if the Qatari were so fast, it’s because they were united around the emir, and had the money and backing of major Western companies.”

This is far from being the case with the Iranians, who do not know yet if they should give priority to the pipelines or to the liquefied natural gas terminals to export the gas from the South Pars field, which they share with Qatar. For the past 10 years, they have watched with resentment as the emirate makes huge progress in the LNG industry, especially since the Qataris probably siphon, unintentionally, part of their gas.

Russia's eastern option

Europeans would also be wrong to believe that as far as oil nationalism is concerned, Iranians are more obliging than the Russians, or more easy to work with when it comes to business.

Total is convinced that Iran will be incapable of exporting to Europe more than 20 billion cubic meters in the foreseeable future — in other words, seven times less than Russia today. This is far from the 90 billion cubic meters mark that Oil Minister Bijan Namdar Zanganeh alluded to. To cut their dependence on Russia therefore means developing more sources of supply.

In Washington, those in Congress eager to use American shale gas against Russia have not given up on their ambitions. But it will take two to three years for the first — and modest — shipments of American LNG to reach Europe. And 10 to 15 years for those from Eastern Africa, provided they don’t all end up in China, India or Japan.

Europe is “competing with Asian countries that don’t hesitate to pay a high price for gas security,” says Claude Mandil, former chief of the International Energy Agency. On the liquefied gas market, there is no mercy.

After the Fukushima nuclear disaster, Japan had to buy a lot of gas, driving the prices up. It is 50% more expensive in Asia than in Europe. That is the price for secure supply contracts. If Europe wanted such shipments, it would need to book them now to encourage the companies that invest in its money-consuming projects. Total and Russian group Novatek have already sold more than two-thirds of the production from the liquefied natural gas plant of Yamal (northern Siberia), although it will not start producing until 2017.

By 2035, Europe will be dependent for 80% of its gas, and could wind up importing a total of 450 billion cubic meters. Many observers reckon that its leaders are determined to cut Russia’s future part in its supplies and to force it to open its market. This shift will be a slow and gradual one. Analysts all agree that Europe will not improve its security by excluding Russia, but rather by improving its energy efficiency, by developing other resources and by diversifying its supply sources. In this game, Iran represents only one of many possibilities.

In Gazprom’s operations center, where its chiefs like to take their hosts to show off their might, the diagrams are already lit up again. A new energy corridor will soon be there too. But the route is pointing eastward: On May 21, Moscow and Beijing signed the deal of the century, guaranteeing the supply of more than 1,100 billion cubic meters of Russian gas over the next 30 years for $400 billion.

By Worldcrunch

The Iran Project is not responsible for the content of quoted articles.

QR code

QR code