Futures rose 3.9 percent�in New York. Iranian Oil Minister Bijan Namdar Zanganeh said it�s �highly probable� OPEC will reach a consensus at the talks, according to comments published by Shana news service.�Iraq will offer plans to help reach an accord, Oil Minister Jabbar Al-Luaibi said.�Discussions went well, Libyan OPEC Governor Mohamed Oun said as he left the group�s Vienna headquarters on Monday evening. Goldman Sachs Group Inc. said the likelihood of an agreement meant the bank was bullish on oil in the short term.

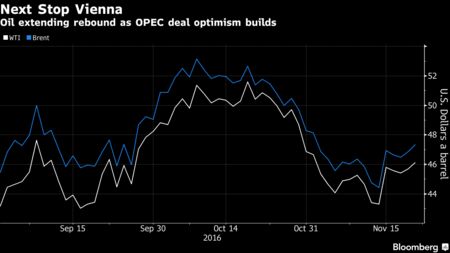

Oil has rebounded from an eight-week low on Nov. 14 as members of the Organization of Petroleum Exporting Countries make renewed diplomatic efforts before their Nov. 30 meeting to finalize the supply deal they agreed to informally in September. The group�s plan to trim output for the first time in eight years is complicated by Iran�s commitment to boost production and Iraq�s request for an exemption to help fund its war with Islamist militants.

�The news flow from OPEC is encouraging,� said Mike Wittner, head of oil-market research at Societe Generale SA in New York. �This could turn on a dime, but for now the noise is positive and points to a deal.�

West Texas Intermediate for December delivery, which expired Monday, rose $1.80 to $47.49 a barrel on the New York Mercantile Exchange. It�s the highest settlement since Oct. 28. Total volume traded was about 11 percent above the 100-day average. The more-active January contract advanced $1.88, or 4 percent, to $48.24 a barrel.

Market Rally

Brent for January settlement climbed $2.04, or 4.4 percent, to $48.90 a barrel on the London-based ICE Futures Europe exchange. It�s also the highest close since Oct. 28. The global benchmark ended the session at a 66 cent premium to January WTI.

U.S. stocks were set for the highest closing level on record, led by energy companies. The S&P Oil & Gas Exploration and Production Select Industry Index rose as much as 4 percent to the highest level since November 2015

The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, fell as much as 0.5 percent. A weaker U.S. currency increases the appeal of dollar-denominated raw materials as an investment. The Bloomberg Commodity Index is heading for the biggest gain since April.

�There�s a lot of jawboning from OPEC, and market participants are positioning in response,� said Michael D. Cohen, the head of energy commodities research at Barclays Capital in New York. �We�re paying attention to signals from the OPEC ministers as they try to finalize an agreement.�

OPEC Jawboning

It�s likely that OPEC members will honor the accord and try to put it into action,�Iran�s Zanganeh said after meeting OPEC Secretary-General Mohammed Barkindo in Tehran on Saturday.�Iraq�s �legitimate demands� shouldn�t be considered an obstacle to reaching a deal to freeze production, Al-Luaibi said.

Russian President Vladimir Putin said he sees no obstacles to an OPEC agreement this month as he reaffirmed Russia is willing to freeze crude output at current levels.�Russia has added more than 400 billion rubles ($6 billion) in projected budget revenue based on this year�s production talks, according to two officials familiar with the government�s calculations.

�Whether an agreement will be reached, I can�t say 100 percent, but there�s a strong likelihood that it will be achieved,� Putin told reporters on Sunday after attending the Asia-Pacific Economic Cooperation summit in Lima.

Goldman Sachs sees WTI at $55 in both the first and second quarters of next year, compared with prior estimates of $45 and $50 a barrel, according to a note on Monday. It lowered third and fourth-quarter estimates to $50 from $55 and $60 a barrel previously.

The bank now forecasts that OPEC will put in place a short-term cut to 33 million barrels a day, while Russia will freeze production.

Oil-market news:

- Money managers, producers and consumers made the biggest bets on WTI in nine years, amid signals more volatility is coming.

- Oil options traders are buying calls before the OPEC meeting, Morgan Stanley said. The put/call skew �has shifted meaningfully toward a bullish bias,� according to a report.

- Oil drillers in the U.S. added the most rigs in 16 months, according to Baker Hughes Inc. data released on Friday.

- US. crude inventories probably increased by 250,000 barrels last week, according to the median in a Bloomberg survey before an Energy Information Administration report on Wednesday.