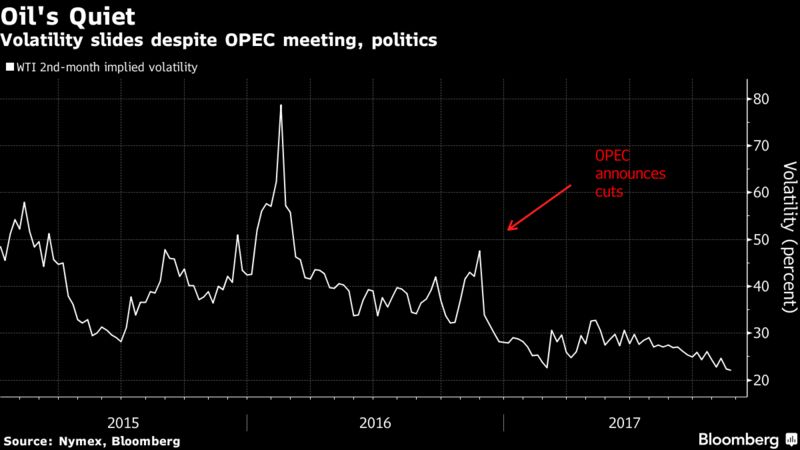

Implied volatility, a gauge of expected price moves, dropped to about 22 percent on Friday for New York-traded crude. That was the lowest level since early March and close to a three-year low. Other gauges of turbulence have also traded at multi-year lows since the start of October, despite the escalating tensions and forthcoming meetings in Vienna at which OPEC and allied oil-producer states will discuss the extension of supply curbs that propped up the market.

The problem for those hedge funds that thrive off sharp intraday price moves is that Organization of Petroleum Exporting Countries already sign-posted its next move: the producer group and Russia, the key non-member partner to the curbs deal, are said to have agreed a�framework�to extend cuts to the end of next year. The options market is pricing in daily price moves of less than 90 cents a barrel for the nearest contract, a historically low level, said Thibaut Remoundos, founder of London-based Commodities Trading Corporation Ltd.

�A priced-in move of under 90 cents a barrel reflects the expectation that Thursday will be not be a shocker and that they will communicate Central Bank-style, containing the price,� he said. A �real pop� would arise if OPEC�s plans disappointed the market and Commodity Trading Advisers, who often buy or sell crude futures based on technical indicators, reversed their �extreme� bullish positions, he added.

Long Trades

Funds have been snapping up bullish bets on crude in recent weeks. There were more than a billion barrels of outright long positions in the Brent and WTI markets combined earlier this month, as expectations grew that OPEC will succeed in rebalancing the market.

There�s always the risk that the outcome of Thursday�s meeting fails to live up to the market�s expectations, sending prices�down. That in turn could spark a sharp increase in volatility, analysts at BNP Paribas SA and JPMorgan Chase & Co. wrote last week.

OPEC�s meeting �could potentially trigger a good sized sell-off in the flat price and a sharp rally in volatility� should the group�s decisions underwhelm the market, JPMorgan analysts including John Normand said.