Overseas shipments will probably stay at 1 million to 1.1 million barrels a day until the terms of a deal between Iran and world powers over the Persian Gulf state�s nuclear program are implemented, allowing sanctions to be lifted, said Amos Hochstein, special envoy and coordinator for international energy affairs at the U.S. Department of State. The U.S. is keeping a �very close� watch on Iranian oil exports, he said in an interview in Singapore.

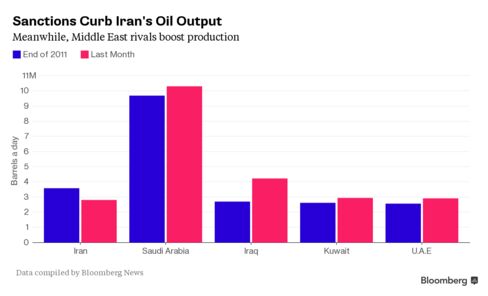

Iran is preparing to increase shipments at a time when crude prices are near six-year lows amid a global glut sparked by the U.S. shale boom. The Middle East producer, which was the second-biggest supplier in the Organization of Petroleum Exporting Countries before sanctions curbed its exports, has vowed to retake market share it lost to producers including Saudi Arabia, Mexico and Russia.

�The stage that we�re in today is that Iran has to implement its requirements under the agreement,��Hochstein said at the Singapore International Energy Week on Tuesday. �Once those are done and they have been verified, then�sanctions will be removed.�

Iran is now the fifth-largest OPEC member, with output in September averaging 2.8 million barrels a day, from 3.6 million at the end of 2011. Countries including China, India and Japan had to get a waiver from the U.S. to buy limited amounts of Iranian crude or risk losing access to parts of the global financial system.

The U.S. waivers for countries still buying the oil remain in place, Hochstein said. �The five countries and Taiwan that have been importing through this entire process through the period of sanctions can continue to do so under the same restrictions that have been applied since the joint plan of action,� he said.

More than two years of negotiations culminated in an agreement of over 100 pages that was signed between Iran and world powers in July in Vienna. The accord survived fierce opposition in the U.S. Congress, where a�Republican�bid to scuttle the deal failed, and among hard-line members of Iran�s parliament.

Brent crude, the benchmark for more than half the world�s oil, tumbled to a six-year low in August as OPEC pursued a strategy of maintaining production in an attempt to drive higher-cost suppliers out of the market. Brent futures dropped 73 cents to close at $46.81 a barrel Tuesday, leaving prices down 18 percent this year.

�I do expect Iran to take advantage of the fact that sanctions are removed and re-enter the energy markets at that time when they�re able to reach those milestones,� Hochstein said, referring to requirements the Middle East nation needs to meet under the nuclear deal.

This article was written by �Sharon Cho for Bloomberg on Aug. 24, 2015.�