Jan 6 (Reuters) -�Iran�has spent almost $25 billion on upstream oil and gas projects since last March but needs to keep�investing�to keep its influence in OPEC, Iran's oil minister said on Sunday.

Jan 6 (Reuters) -�Iran�has spent almost $25 billion on upstream oil and gas projects since last March but needs to keep�investing�to keep its influence in OPEC, Iran's oil minister said on Sunday.Iranian oil production fell sharply last year, as Western nations tightened sanctions to starve Tehran of funds for its disputed nuclear programme, allowing�Iraq�to overtake�Iran�as the oil exporting group's second-largest producer.

The sanctions, aimed at stopping what the West says is a weapons programme but which Tehran says is purely peaceful, have slashed tens of billions off Iranian oil revenues over the past year and weakened OPEC price hawk Iran's influence in a group now effectively steered by�Saudi Arabia.

Iranian officials have maintained a brave face as exports have fallen to about half levels seen in 2011, arguing that selling less crude is good for the�economy�while calling for more�investment�to boost capacity and refine more crude into finished fuels.

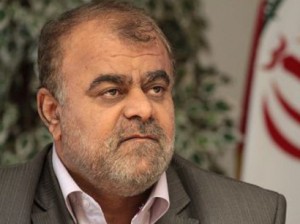

"We should raise production capacity in the mid-stream sector and protect our place in OPEC with regard to sensitivity of the oil market and at the same time try to curb selling materials in raw form," oil ministry news website Shana reported oil minister Rostam Qasemi as saying at a�finance�conference in Tehran.

Qasemi said as much as $400 billion dollars of energy sector investment was needed over five years, although Iran already struggles to sell the oil it already produces because of pressure from Washington on big Asian�customers�to buy less.

International banking restrictions have made it very difficult for Iranian oil buyers to send funds to an isolated Islamic Republic seen by many investors as high risk.

Qasemi said foreign investment in Iran's oil and gas sector had nevertheless risen to $20 billion dollars recently, according to Shana.

Iran's central bank has also agreed to channel funds it has been holding in foreign banks - largely because of difficulties repatriating export�earnings�- into oil industry projects in Iran, Qasemi said, without explaining how it could be done.

Isolated from international credit lines and western technology during a long standoff with Washington, Iran has resorted to issuing bonds to generate funds for energy projects.

In the latest sale, Iran Offshore Oil Company (IOOC) plans to issue rial denominated bonds on Monday, offering 20 percent interest over four years, Shana reported on Sunday.

Shana said that under this year's annual budget, several government ministries had also been given permission to issue billions of dollars worth of bonds to fund oil projects.

Even investors who specialise in high risk debt say the many banking obstacles are likely to deter any foreign investors in Iranian bonds.

The International Energy Agency (IEA) estimates that Iranian oil exports have slumped from 2.2 million bpd at the end of 2011 to just 860,000 bpd in September 2012.

By Reuters

The Iran Project is not responsible for the content of quoted articles.